Approach

The focus of this blog article is on gold and silver miners from a tactical point of view: how do PM miners perform relative to the price of gold or silver. Since the start of the gold bull, did precious metal miners by far outperform the gold and silver they produce?

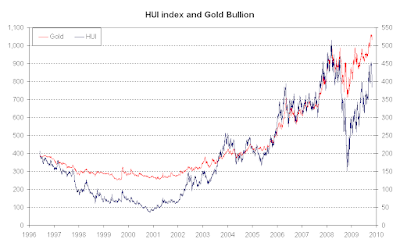

For nearly eight years they surely did. Gold miners shown are represented by the HUI, ticker symbol for the AMEX "basket of unhedged gold stocks". The graph below shows both the HUI index and gold bullion; further down the characteristics shown is the HUI/Gold ratio, giving an obvious idea on how cheap or expensive gold stocks are relative to bullion.

The glorious early bull

|

| Gold (red) on the left scale in USD/Oz and HUI index (blue) or the right scale. Scales compare 2:1 making a $2 change on gold bullion equivalent to a 1 point change on the HUI. - click to enlarge |

During the epic first years of gold bull, the HUI index rose from 37.88 (on Nov 1, 2000) to 514.89 (on March 14, 2008), a 13.6 fold rise. Over the same time, gold bullion rose from $265.5/Oz to its first fixing above $1000 on the LBMA at $1003.5/Oz, a 3.78 fold rise.

The HUI index outperformed gold bullion by an impressive factor of 3,57 over that time stretch. Now isn't that the kind of picture always shown by analysts eager to warm up sentiment on gold mining stocks? What remains of the glorious early bull...

The HUI index outperformed gold bullion by an impressive factor of 3,57 over that time stretch. Now isn't that the kind of picture always shown by analysts eager to warm up sentiment on gold mining stocks? What remains of the glorious early bull...

put in a longer term perspective?

Just imagine you figured out too early gold had reached a bottom and you too eagerly started investing in gold stocks mid 1996. The HUI index goes back to June 4, 1996. What happened after March 2008 you remember more vividly. I therefore extend the time range to October 2009, when gold finally broke above $1000/Oz never to return below. This is what the above graph then looks like:

|

| Gold (red) on the left scale in USD/Oz and HUI index (blue) or the right scale. Scales compare 2:1 making a $2 change on gold bullion equivalent to a 1 point change on the HUI. - click to enlarge |

A little more worried? You should be.

Investing in bullion 'too early', being taken by surprise in autumn 08 and holding on through the recovery till Oct 2009 you still realized a return of 167% on your capital. Over the same period, the HUI index lagged with a 87.6% increase.

There's nothing left of the outperformance of gold mining stocks: potential gains have been consumed by being in way too early, as gold mining stocks were hammered in the late bear years: the HUI index dropped from 208.41 till 37.88 (18.2% of its June 96 value) on Nov 1 of 2000. The actual minimum was 35.99 later that month. Further on, gold stocks were beaten up during the autumn 2008 collapse of financial markets. The epic 2009 recovery didn't quite make up for that: HUI ends at 390.9 on this graph: below its March 2008 level. Gold bullion ends at $1040/oz, fully recovered from its 30% loss incurred.

Unhedged Gold miners relative to Gold bullion (longer term)

Following graph shows the HUI index and HUI/Gold ratio since June 1996. At every increase in the graph, gold miners are outperforming bullion. High values mean expensive gold mining stocks. Obviously the Oct 2009 situation where we left off above hasn't improved at all. Despite gold bullion rising 50%, the HUI hardly quotes above the 390.9 level of end October 2009. Mid May, we even revisited that level, with the HUI bottoming around 380, good for a HUI/Gold ratio short of 0.25.

|

| HUI (left axis in blue) and HUI/Gold ratio (right axis in dark green) from June 1996 till end June 2012 - click to enlarge |

The HUI index used to quote around half of the bullion price in USD/oz in 1996 before the onset of the final gold bear market. Three successive major minima of HUI/Gold occur. A first bottom in the HUI/Gold ratio with gold quoting around $260/Oz in Nov 2000; a second minimum during the Autumn '08 financial crisis with gold around $700/oz and a last minimum on May 15&16 with gold as high as $1540.

What are we missing out?

Unless higher bullion prices completely failed to translate into higher mining profits, what have we missed out?

Corporate response to the gold price level and trend: The wear and tear of the late 20th century gold bear has been a real challenge for gold miners.

- Those miners adopting a hedging policy early on, have been able to lock in gold prices ranging between $350 and $400/oz which could take them through the worst period.

- Almost all miners turned to 'high grading' whenever possible. This is the preferential mining of high grade ore, resulting in a low cash cost per ounce produced. Miners avoided negative cash flows... at the expense of exhausting the best of their gold reserves.

- Gold miners called off prospecting for new reserves: they could hardly afford it.

Strength become weakness

- Miners having the best cards (read: the better hedging contracts) have been able to acquire some of their less fortunate competitors 'on the cheap'. Barrick has been one of those ultimate consolidators, contributing much to its good performance in the early bull years.

- Clinging on too long to a fruitful corporate policy unfortunately also turns against you. Again Barrick and Anglogold have been buying back hedge contracts while 'deep under water', jeopardizing future profits and diluting existing shareholders by issuing new shares.

- Gold miners having exhausted their best reserves turned to 'low grading'. Quite often lower grade ore was all what was really left. This implies cash cost rising with the bullion price, while profits stay flat.

- Management teams had been oriented towards cost control for existing mining operations; skills for expansion investments were around much less: miners had cut back on their teams of seasoned geologists.

- Higher stock prices lead to raising new capital more often. Almost without exception, miners failed to deliver on promises: new projects rarely got built on schedule or within budget. Hefty sums were paid for reckless acquisitions, at the expense of diluting shareholders.

- New mining exploitations generally have an ore grade lower than what used to be mined in the old exhausted pits.

- Gold miners 'that got it right', were still facing stiff competition in having investment goods delivered timely, escpecially since base metal miners started their investment cycle at the same time.

- Cash costs were escalating with crude prices (for open pit mining) and with higher steel costs and electricity shortfalls (for underground mining).

- Among juniors, "mining the markets" (rather than mining for gold ore) became more than a 'Vancouver insider' whisper.

Competing products and investor sentiment

- The GLD gold bullion ETF has been gobbling up billions worth of investor money. While providing some support for gold bullion prices, this also drains money away from the gold mining oriented investments.

- The rise of some hedge fund policies, such as going long the precious metals while shorting the miners, has much contributed in driving down miner valuation to the level we've witnessed mid May 2012.

- Investors have been disappointed by the poor corporate performance, related to the above weakness.

- After over a year of precious miner weakness -despite a gold rally leading up to the August-September all time high- the negative bias towards PM miners has reached a climax: weakness begets weakness. The miners slump has worn out investor sentiment.

Yet going forward:

- Investors so far failed to realize that corporate profits ultimately have started to pick-up after a lengthy cycle of investments paying off and the expiration or scaling down of hedge contracts.

- Miners are starting to pay dividends or are increasing the dividend paid. This strongly supports the idea that the rise of corporate profits is sustainable.

- Investors focusing on lower average ore grades fail to see the bigger picture: mostly those new low grade exploitations are open pit mines, replacing exhausted deep underground mines. Total cash costs are not inversely proportional to the gold ore grade. Moreover the open pit exploitations generally also contain secondary metals. Open pit gold/copper (or copper/gold) are among the more frequent new mining operations.

- From a tactical point of view: a hedge fund policy of "going long the precious metals while shorting the miners" is to continue only while profitable. Sooner or later this policy will be reverted, giving rise to a new cycle of miners outperforming bullion. This may already have started soon after the mid May bottom on relative valuation.

Finally, I don't need to revert to the zero-interest rate policy or to profligate QE as the main drive for future much higher gold bullion prices. While those may jump start a major rally in mining stocks, they potentially also lead to a sustained increase of mining costs and higher investement budgets going forward.

Unhedged Gold miners relative to Gold bullion (the short term)

The HUI index had dropped dramatically giving up the 400 support level in May. Is the worst over? HUI/Gold is drifting around 0.27. There's a long way to go...

|

| Unhedged Gold Miners index HUI relative to gold bullion (spot market). Daily observations. Last update Jun 29 - click to enlarge |

From 0.40, the middle of its post 2008 trading range, the ratio is still down over 30%. Through gold recoveries and pull-backs, HUI/Gold stays below its declining 200 dma, and first breaking the 0.30 support on Jan 19-24. Early March the slide aggravated. Prior to May, the HUI/Gold ratio dropped below 0.25 only for some short stretches of time, totalling 11 trading days at the very bottom of the 2008 collapse of financial markets.

Weekly observations allow to put the daily observation graph into perspective: the 'post 2008 trading range on HUI/Gold relative valuation used to be around 0.40. The slide has been in several phases: an initial leg down in March-June 2011, with stock markets first shocked by the Japan earthquake, tsunami and nuclear catastrophe and later on by a more global weakness. The 2011 gold rally is but a brief support, preventing the HUI/Gold from collapsing any further. As gold weakens into autumn 2011, stock markets regain footing. After the Jan-Feb 2012 gold recovery falters, the second leg down starts, driving HUI/Gold from 0.30 to below 0.25 by mid May.

| |

|

Global X Silver Miners ETF (SIL) relative to silver bullion

Since reaching a bottom mid May, silver miners have been recovering, with the ratio SIL/silver between the 50 dma and the 200 dma. |

| Silver miners are observed through the GlobalX ETF : SIL. Daily observations of SIL/Silver bullion. Last update June 29 - click to enlarge. |

Weekly observations: The Global-X silver miner ETF was launched in spring 2010. Weekly observations go back over 2 years by now. The April 2011 parabolic rise of silver bullion made the SIL/Silver ratio fall off a cliff. Silver mining investors were factoring in that those prices were not sustainable. Simultaneously, there were some issues about political threats in Latin America. The late April 2011 swoon has been a solid bottom for SIL/Silver, yet the much lower silver prices prevailing now aren't really much help either in supporting silver miners.

|

| Global X silver miners ETF (SIL) relative to silver bullion - Weekly observations, with 10 weeks and 40 weeks moving average. (click to enlarge) |

Canadian Gold and Silver Mining indices

No better illustration of gold miners underperforming than the capitalisation weighted gold miners index of stocks included in the Gold Miner Pulse database (GMP)? Note that all quotes are in CAD, which has been fluctuating to the USD. The silver miners index (blue square symbols) lost its edge as silver turned from outperforming gold to underperforming it. Early 2012 brought relief, but sentiment again turned sour for both gold and silver miners. We continued setting fresh lows on the three miners indices until mid May... and the recovery is still uncertain. |

| Gold Miners index, Silver miners index and Equal Weight Index , base Nov 19, 2010 - Last update: Jun 29, click to enlarge |

Performance graph

There is an important disparity among the gold and silver miners of the GMP database. Few lucky picks have been outperforming silver or gold by an impressive margin. Too many laggards have lost considerably. Only 20 of the miners are still above their Nov 19, 2010 mark. The median miner (in the middle, with an equal number better and worse) loses 42%.

|

| Gold Miners index, Silver miners index and Equal Weight Index , base Nov 19, 2010 - Last update: Jun 29, click to enlarge |

Eight miners lose 80% or more:

- Kiska Metals Corporation

- AM Gold Inc.

- Crazy Horse Resources Inc

- Atlanta Gold Inc.

- Aura Minerals Inc.

- Golden Minerals Company

- Plato Gold

- Soho Resources

On the graph NGEx Resources has doubled. However, two more miners are still running off scale: Pretivm Resources and Rio Alto. A detailed and fresh set of graphs on Canadian miner performance included on the page "miners news".

The graphs with daily observations over 6 or 12 months in the above sections are updated on a regular basis on the blog page "gold miner pulse".

Further reading

The relative performance of mining majors to the precious metals they produce has been disappointing, both for major gold and for silver miners. Following blog articles have a time perspective covering years or decades.

Several more articles, using this same approach, have been published later on:

- Miners relative to precious metals: An update on 2012; (Jan 13, 2013)

- Anatomy of a gold miner bear market (Dec 30, 2013)

- Three year slide of precious metal miners (Dec 31, 2014)

More articles suggesting gold miners soon to respond to rising bullion prices:

- Nick Barisheff: Will rising tide lift all boats ?

- John Hathaway: The lengthy 10 month correction in gold is over

- Adam Hamilton: Gold stock valuations (8)

Very good!I like this article,please follow us,We can supply gold mining equipment.

ReplyDeletegold mining equipment.